Introduction

Gold is well-known as a financial system in which a country’s forex has a fee at once connected to Gold. Under the Gold Act, nations agreed to transform paper cash into a set amount of Gold. This gadget was widely used in the nineteenth and early 20th centuries; however, it progressively fell out of fashion in the twentieth century. This article explores the origins, rise, workings, and eventual decline of the Gold preferred and its lasting impact on the worldwide economic system.

1.Origins of the Gold Standard

Early Use of Gold as Money

Its specific properties—durability, divisibility, and intrinsic cost—made it an excellent form of currency. Ancient civilizations, including the Egyptians, Greeks, and Romans, used gold coins in exchange and trade.

The Classical Gold Standard (1816-1914)

The gold trend as a formal monetary machine began in the early 19th century. In 1816, the United Kingdom became the first United States of America to adopt the Gold form preferred. By 1870, many of the world’s leading economies, such as America, Germany, and France, had followed suit.

Under the classical Gold well known, the cost of a rustic currency became immediately linked to a selected amount of Gold. Governments agreed to alternate their currency for Gold at a set rate. This system provided a stable exchange fee, which facilitated international exchange and funding.

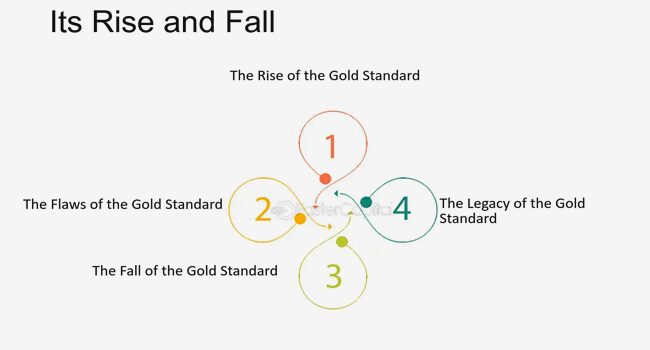

2.The Rise of the Gold Standard

Economic Stability and Growth

The widespread use of Gold contributed to monetary stability and growth throughout the 19th century. It furnished a dependable and predictable economic system, decreasing the danger of inflation and deflation. Fixed trade fees below the gold popular promoted global exchange, as groups and traders could depend on stable currency values.

Expansion of International Trade

The balance provided by the gold trend endorsed the enlargement of global trade. Countries with robust economies and strong currencies have been able to appeal to overseas funding, fostering economic growth. The gadget also facilitated the development of global monetary markets, as gold-backed currencies had been extensively customary and relied on.

The Role of Central Banks

Central banks played an essential role in retaining popular Gold. They controlled gold reserves and ensured that forex in the movement would be exchanged for Gold upon demand. Central banks also motivated interest quotes to hold the constant change fee, using equipment that includes open marketplace operations and reductions.

3.Mechanisms of the Gold Standard

Currency Pegging

Under the gold standard, each U.S. currency becomes pegged to a selected quantity of Gold. For example, the U.S. Dollar is equivalent to one-twentieth of an oz of Gold. This meant that the U.S. Government became devoted to changing dollars for Gold at this constant charge.

Gold Reserves

Countries wanted large gold reserves to preserve the Gold preferred. Gold reserves acted as an assurance that the foreign money might be transformed into Gold upon call. Central banks held these reserves and controlled them to ensure the stability of the financial machine.

Balance of Payments Adjustment

The gold standard additionally facilitated automatic changes in the balance of payments. If a country experienced a change deficit, Gold would float out to pay for imports, lowering the cash supply and leading to deflation. Conversely, an exchange surplus might result in gold inflows, growing the money supply and causing inflation. These adjustments helped to correct imbalances in global change.

4.The Decline of the Gold Standard

World War I and Economic Disruption

The outbreak of World War I in 1914 marked the start of the end of the classical gold trend. The war triggered massive financial disruption, causing many nations to drop the gold standard to finance army costs. The desire for flexibility in monetary policy during the war made rigid Gold popular and untenable.

The Interwar Period and Attempts at Restoration

After World War I, efforts were made to repair the gold general. The most first-rate strive turned into the Genoa Conference in 1922, which sought to set up a gold change trend. Under this device, international locations may want to keep overseas currency reserves (together with the U.S. Dollar or British pound) in addition to Gold.

The Gold preferred became, in short, restored within the overdue Twenties. However, it became risky. Economic conditions had modified, and the global financial system was less integrated than in earlier warfare. The stress of the gold trend made it tough for international locations to reply to economic crises.

The Great Depression and Abandonment

The Great Depression of the 1930s dealt a fatal blow to the Gold preferred. The economic downturn brought about large deflation, unemployment, and financial instability. Countries struggled to preserve the constant exchange fees, and the limitations of the gold popularity exacerbated the crisis.

In 1931, the U.K. abandoned the gold general, as observed by the USA in 1933. These actions allowed nations to pursue greater flexibility in economic regulations to combat financial despair.

5.The Bretton Woods System

Establishment and Functioning

In 1944, in the direction of the giving up of World War II, the Bretton Woods Conference installed a new international economic device. The Bretton Woods device was a changed model of the gold standard. Under this system, the U.S. Dollar was pegged to Gold at $35 in step with ounce, and different currencies were pegged to the greenback.

The Bretton Woods system aimed to offer the stability of Gold while maintaining some flexibility in monetary policy. Countries could regulate their alternate fees within a narrow band to deal with financial imbalances.

Role of the International Monetary Fund (IMF)

The Bretton Woods device additionally hooked up the International Monetary Fund (IMF) to supervise the worldwide economic machine and provide financial help to international locations dealing with balance of payments problems. The IMF played a vital role in maintaining the stability of the Bretton Woods device.

6.The Collapse of Bretton Woods

Economic Challenges inside the Nineteen Sixties

By the 1960s, the Bretton Woods system confronted large challenges. The U.S. Dollar, the anchor of foreign money, became under stress due to massive budget deficits and alternate imbalances. The growing delivery of dollars held via foreign principal banks passed the U.S. Gold reserves, undermining self-belief in the dollar’s convertibility to Gold.

Nixon’s Shock and the End of Gold Convertibility

correctly finishing the Bretton Woods gadget. This flow, known as the Nixon Shock, marked the transition to a machine of floating change costs, in which the price of currencies is decided via marketplace forces.

Transition to the Fiat Currency System

The end of the Bretton Woods gadget marked the start of the fiat forex generation. Under this system, currencies aren’t sponsored through physical commodities like Gold; they derive their cost from authorities’ decrees and market acceptance as true. This transition allowed for extra flexibility in economic policy; however, it additionally added new demanding situations, which include alternate rate volatility and inflation management.

7.Impact and Legacy of the Gold Standard

Economic Stability and Growth

Gold is well-known for contributing to monetary balance and increased at some stage in its peak. It supplied a predictable economic machine, reducing inflationary and deflationary pressures. The stability of alternate charges below Gold’s popularity facilitated global alternate and investment, fostering monetary improvement.

Limitations and Challenges

Despite its advantages, Gold had enormous limitations and was in demanding situations. The pressure of fixed trade quotes made it hard for international locations to respond to economic shocks and crises. The need for substantial gold reserves also restrained financial policy, restricting governments’ capacity to cope with domestic monetary issues.

Influence on Modern Monetary Policy

The legacy of Gold, which is well known, continues to influence modern economic coverage. Central banks nowadays intend to reap rate balance, a precept that has become principal to the Gold preferred. However, the flexibility of fiat forex structures allows for more responsive and adaptive monetary guidelines.

Conclusion

The upward thrust and fall of the gold standard constitute an enormous bankruptcy within the records of worldwide financial structures. The widespread use of Gold furnished balance and facilitated financial increase at some point in the 19th and early 20th centuries. However, its pressure and the economically demanding situations of the twentieth century brought about its decline.

The transition to the fiat currency system marked a new generation in financial policy characterized by greater flexibility and adaptability. While the gold standard is not in use, its principles and training still shape present-day economic thought and coverage. Understanding the history of the gold standard affords valuable insights into the complexities of world finance and the continued quest for financial stability and prosperity.

FAQs

1. What is the Gold popular?

Answer: Gold is widespread in a financial system in which a rustic’s foreign money is immediately linked to Gold. Under this device, governments agreed to trade paper money for a fixed amount of Gold. This supplied a solid price for the currency and facilitated global trade.

2. When did the well-known Gold first come into use?

Answer: The formal adoption of Gold started in the early 19th century, with the United Kingdom officially adopting it in 1816. By the late nineteenth century, some of the world’s main economies had followed the gold standard.

3. What had been the main blessings of the gold standard?

Answer: The principal blessings of the Gold preferred covered financial balance, decreased inflation and deflation hazard, and fixed trade fees that facilitated international trade and funding. It provided a predictable financial system that recommended monetary growth.

4. How did the Gold prefer to contribute to monetary stability?

Answer: The widespread Gold contributed to economic stability by offering a hard and fast fee for forex, which reduced the uncertainty in worldwide change and investment. The system’s guidelines helped save you from immoderate inflation and deflation, selling strong monetary conditions.

5. Why did the gold standard decline all through the twentieth century?

Answer: The gold trend declined because of sizeable monetary disruptions as a result of World War I, the Great Depression, and the want for more bendy economic guidelines. The inflexible shape of the gold general made it difficult for international locations to reply to monetary crises correctly.

6. What turned into the Bretton Woods device?

Answer: The Bretton Woods gadget, installed in 1944, changed into a changed version of the gold standard. Under this machine, the U.S. Greenback turned pegged to Gold, and different currencies were pegged to the dollar. It aimed to combine the steadiness of the gold fashionable with some flexibility in financial coverage.

7. Why did the Bretton Woods system fall apart?

Answer: The Bretton Woods system collapsed due to financially challenging situations in the Nineteen Sixties, including big U.S. Budget deficits and change imbalances. In 1971, President Richard Nixon suspended the dollar’s convertibility into Gold.

8. What is a fiat foreign money device?

Answer: A fiat currency machine is a monetary device in which physical commodities like Gold don’t always sponsor the fee of forex but are derived from government decree and marketplace trust. This machine permits more flexibility in economic coverage; however, it can result in challenges, such as inflation and trade price volatility.

9. What are some limitations of the Gold well-known?

Answer: Limitations of the preferred Gold include its tension, which makes it hard for countries to respond to financial shocks and crises. The desire for big gold reserves constrains economic coverage, limiting governments’ ability to address domestic monetary problems successfully.

10. How has the legacy of the fashionable Gold inspired present-day economic policy?Answer: The legacy of Gold is well-known and continues to persuade cutting-edge financial coverage through its emphasis on rate balance. Central banks nowadays strive to maintain stable expenses and control inflation, ideas that have been significant to the fashion of Gold. However, the ability of fiat currency systems permits for greater adaptive and responsive economic rules.